5 Ways to Calculate Expected Value in Excel Easily

In this post, we’ll explore five simple methods to calculate expected value using Excel. Whether you’re dealing with probabilities in a business scenario, statistical analysis for research, or simply trying to understand the likelihood of outcomes in everyday decisions, Excel’s functionality can simplify these calculations significantly.

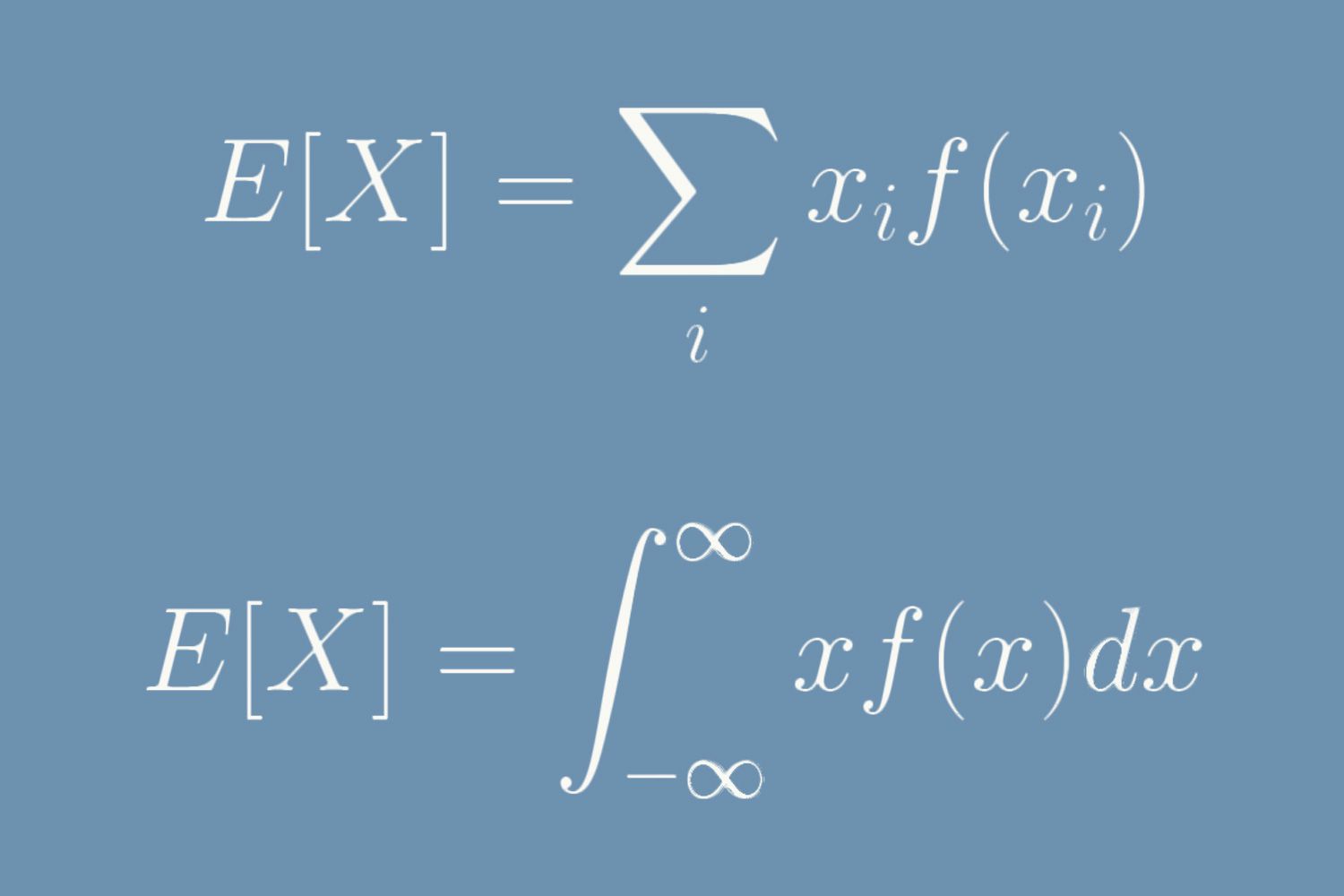

Expected Value: What and Why?

The expected value (EV) is a fundamental concept in probability and statistics, representing the long-term average of a random variable if the experiment were repeated many times. Here’s how it’s generally calculated:

[EV = \sum (Probability * Outcome)]

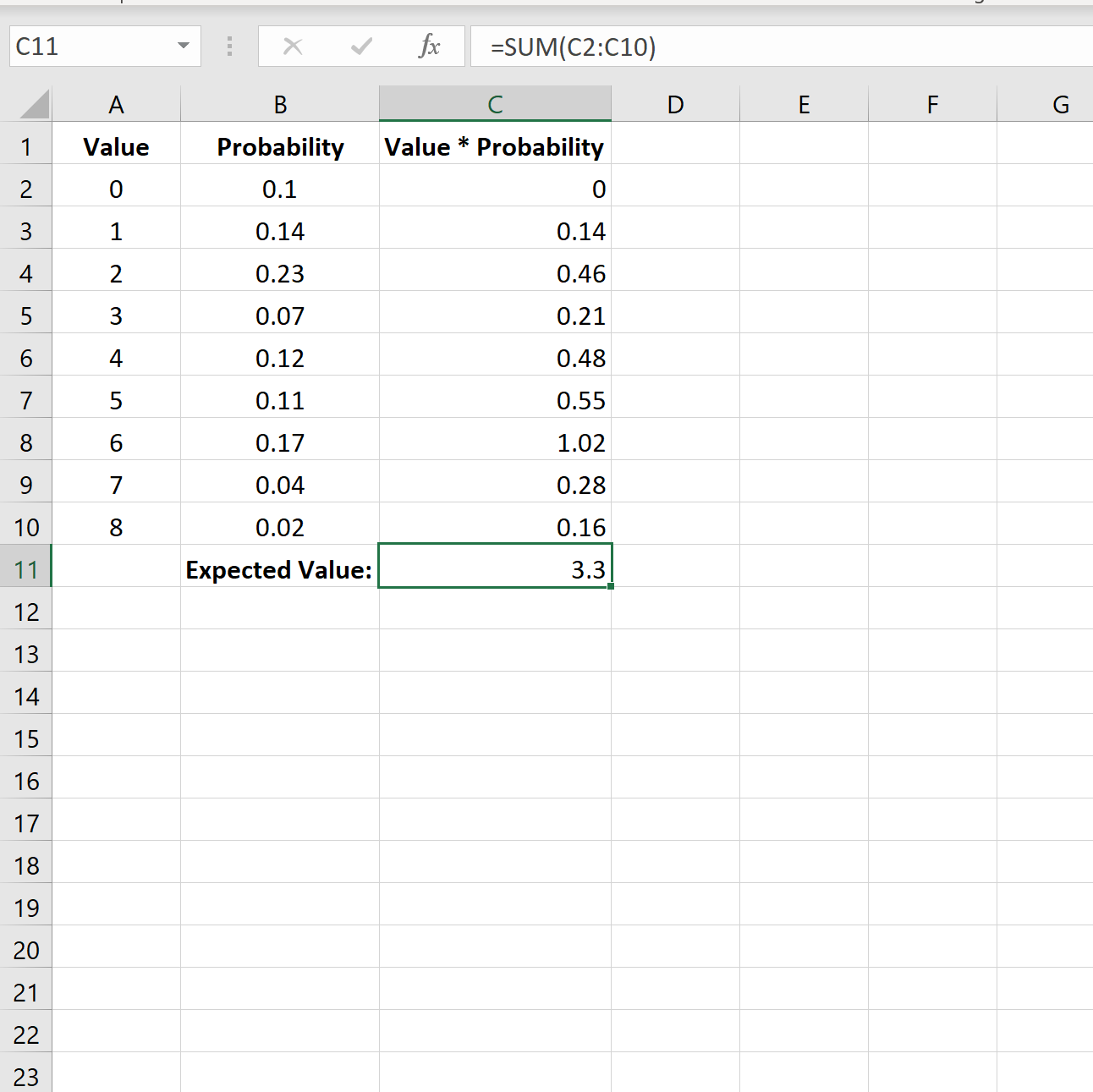

1. Basic Formula Approach

For straightforward cases:

Data Preparation: Enter your possible outcomes in one column (let’s say Column A) and their corresponding probabilities in another (Column B).

Calculating EV: In a new cell, use the formula:

<table>

<tr>

<td>Expected Value Formula</td>

<td>=SUMPRODUCT(A2:A10, B2:B10)</td>

</tr>

</table>

This function multiplies corresponding elements in arrays and returns the sum of those products.

📝 Note: Ensure the ranges in the SUMPRODUCT formula match the cells where your outcomes and probabilities are located.

2. Using AVERAGEIF for Conditional Probabilities

When outcomes depend on specific conditions:

Identify Conditions: Decide what conditions will apply to your outcomes (e.g., certain products selling more on specific days).

Formula: Use:

=AVERAGEIF(condition_range, "condition", outcome_range) * probability

You’ll need to adjust this formula for different conditions.

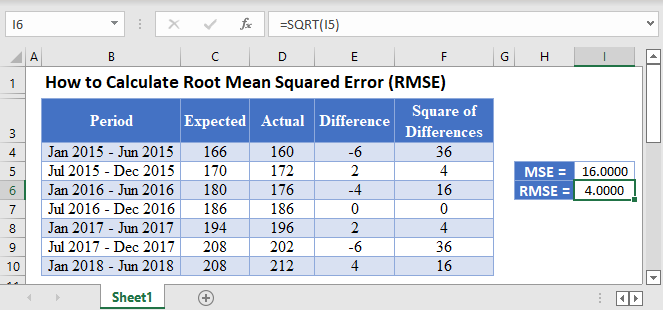

3. Complex Scenarios with Data Table

For more intricate scenarios:

Create a Data Table: Use Excel’s Data Table feature to analyze multiple variables at once.

- Enter the varying factors as rows and columns, with the formula in the top-left cell.

Excel Formula: Use Excel’s Formula to calculate EV:

<table>

<tr>

<td>Expected Value Formula</td>

<td>=SUMPRODUCT(DataTableColumn, DataTableRow)</td>

</tr>

</table>

This method allows for dynamic analysis with different variables.

4. Scenario Analysis

Create Scenarios: Use Excel’s Scenarios to define different sets of values for your variables.

Calculating EV: Insert a scenario summary sheet and calculate EV as before:

<table>

<tr>

<td>Expected Value in Scenario Analysis</td>

<td>=SUMPRODUCT(outcome_range, probability_range)</td>

</tr>

</table>

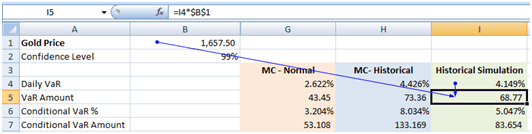

5. Monte Carlo Simulation

- Set Up: Define a range of values for outcomes and probabilities. Then, use:

=RAND() * (MaxValue - MinValue) + MinValue

Repeat Simulations: Use Excel’s macro or the RANDBETWEEN function for multiple trials.

Calculate EV: Use:

<table>

<tr>

<td>Expected Value from Simulation</td>

<td>=AVERAGE(simulation_results_range)</td>

</tr>

</table>

This method gives a statistically robust estimate of EV.

Summarizing Key Points

We’ve explored how Excel can be leveraged to calculate expected values through:

- Basic formulas for simple cases.

- Conditional averaging for more specific outcomes.

- Data tables for analyzing multiple variables at once.

- Scenario analysis to compare different future outcomes.

- Monte Carlo simulations for more robust statistical estimations.

By understanding and applying these techniques, you can enhance your decision-making process in various fields where probabilities play a critical role.

What is the significance of calculating expected value?

+

Expected value gives you an average outcome over many repetitions, helping in decision making by providing a measure of the central tendency of a probability distribution.

How do I choose the right method to calculate EV?

+

Choose based on the complexity of your data and the accuracy required. Basic formulas are good for simple scenarios, while simulations are better for complex probability distributions.

Can I calculate expected value with Excel without advanced features?

+

Yes, using basic formulas like SUMPRODUCT is quite accessible even if you’re not familiar with Excel’s advanced functionalities.